Note that as an employee, you won’t be able to claim mileage as a tax deduction in case your employer doesn’t reimburse you, according to the Tax Cuts and Jobs Act. Continue reading to learn more about keeping IRS mileage records. In order to be reimbursed for your business driving, you need to provide records of your mileage. Learn more about the differences between the IRS standard mileage rate reimbursement, the FAVR method and mileage allowance. Any excess mileage will be taxed as a part of your income. Keep in mind all types of reimbursement payments, no matter the chosen method, have to work out to be no higher than the IRS mileage rate per mile. A mileage allowance is typically paid upfront on a monthly basis, so you have cash on hand for your month’s business mileage expenses.FAVR consists of two separate payments, one to cover fixed, and another to cover variable costs.The standard mileage rate is meant to cover all fixed and variable costs of using your vehicle for business driving and is typically paid out once you have provided a log of your business mileage.Your employer may reimburse you at the standard IRS mileage rate, at FAVR (fixed and variable rate), or provide you with a fixed monthly mileage allowance. This is the case, for example, in California. While there are no federal laws requiring employers to reimburse their employees’ mileage, state laws sometimes require mileage reimbursement. If you drive your personal vehicle for business purposes, you might be entitled to mileage reimbursement from your employer. Mileage reimbursement rules For employees Read more about reimbursement as a taxable income. However, if you are reimbursed at a higher rate than the standard IRS rates, any excess is taxed as part of your income. Mileage reimbursement is not considered a benefit, so it is not taxable as income. Meeting clients and going on customer visitsįor more information and examples on what qualifies as business mileage, see the IRS publication on transportation.Travelling between two different places of work.Some common types of trips that are considered business-related include: The IRS defines business mileage as mileage that is driven between two places of work, permanent or temporary.

What is considered to be business mileage? Learn more about the 2023 IRS mileage rates, and see the previous IRS mileage rates 2022. 18 cents per mile for medical and moving purposes.58.5 cents per mile for business purposes.The official mileage rates from the start of 2022 until June 30th, 2022 14 cents per mile for charitable purposes (this rate remains the same).

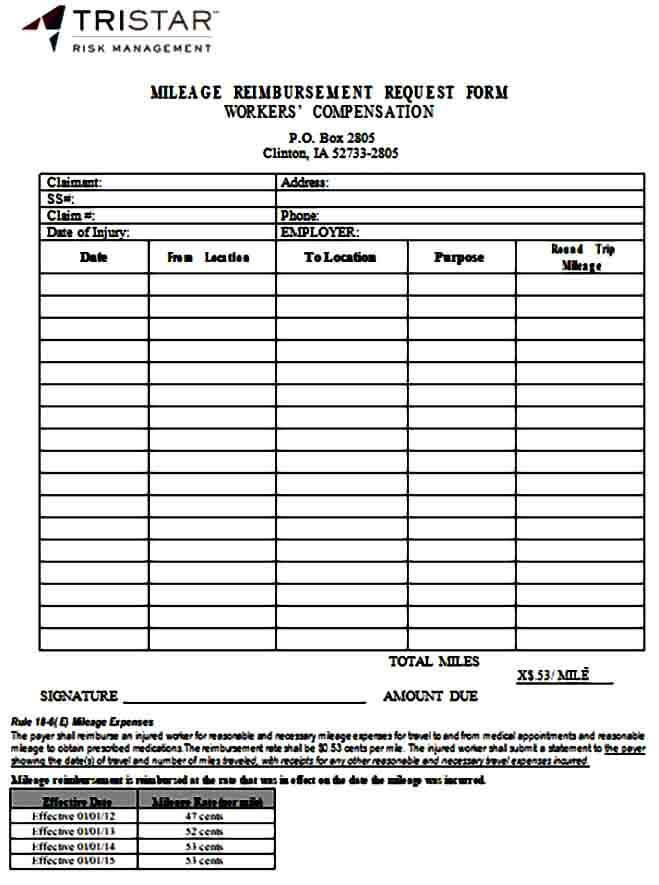

65.5 cents per mile for business purposes.What is the current federal mileage reimbursement rate? Self-employed and independent contractors can deduct business mileage expenses from their taxes, and employers who provide mileage reimbursements to employees can account for these as business expenses. When employees regularly use their own vehicles for company activities, some firms prefer to set a monthly fixed amount for compensation. Mileage reimbursement is normally calculated on a per-mile basis and covers all expenses of owning and running your vehicle for business purposes. The IRS mileage reimbursement covers the use of specific vehicles, namely: cars, vans, pickups, and panel trucks. The reimbursement covers all costs of owning and driving your vehicle for the qualified miles. Mileage reimbursement is the reimbursement you receive for using a personal vehicle for business purposes. The Driversnote mileage tracking app is always up to date on laws and the IRS mileage rates. Log your business travel and calculate your reimbursements automatically.

0 kommentar(er)

0 kommentar(er)